Weekend Stock Market Outlook – September 29 2024

Stock Market Outlook entering the Week of September 29th = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place as we close out the third quarter.

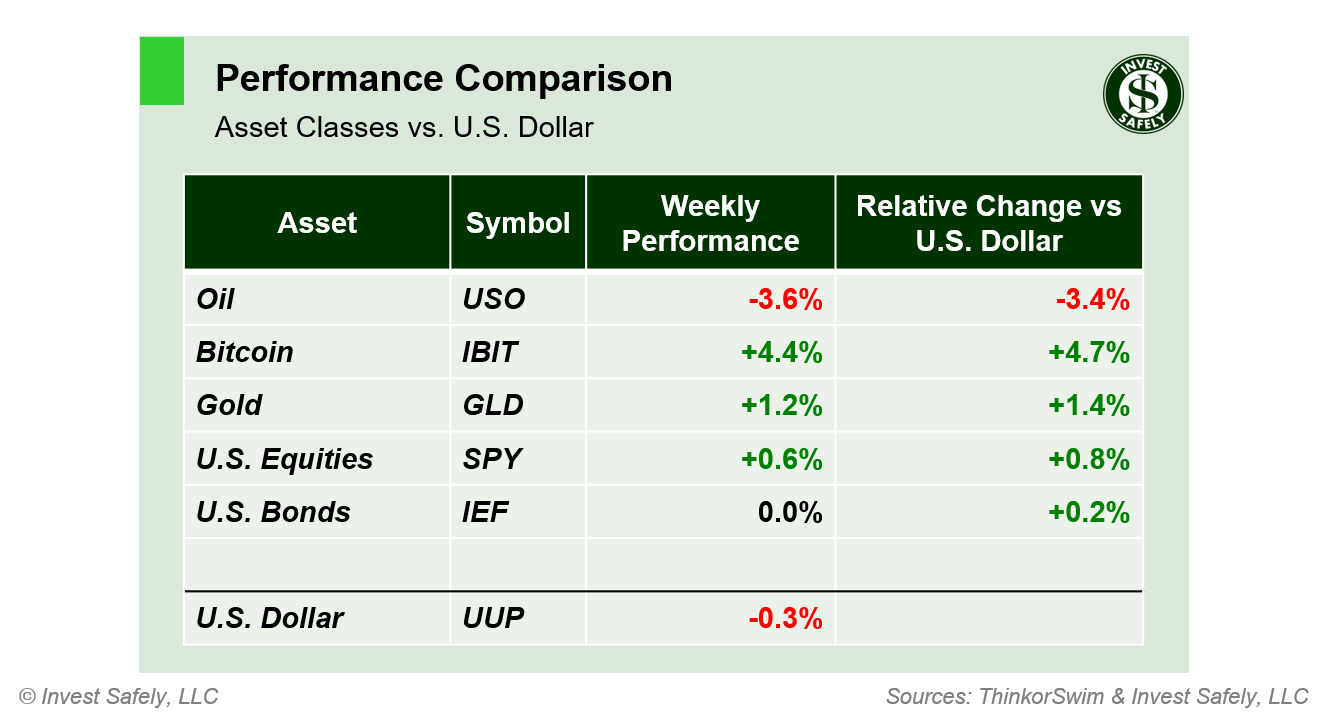

The S&P500 ($SPX) rallied 0.6% last week. The index sits ~4% above the 50-day moving average and ~10% above the 200-day moving average.

All three indicators (Average Directional Index, On-Balance Volume, and Institutional Activity) remained bullish last week.

Materials ($XLB) outperformed the broader market last week, reflecting the strength in commodities (excluding oil and gas) and perhaps frontrunning money spent supporting regional rebuilding efforts after hurricane Helene. Energy ($XLE) was the laggard, thanks in large part to the weakness in oil and gas.

Style-wise, High Beta ($SPHB) was the best sector for the third week in a row, while small cap value ($IWN) was the worst performer. Risk-on indeed.

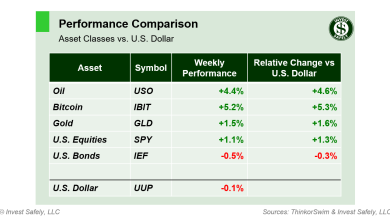

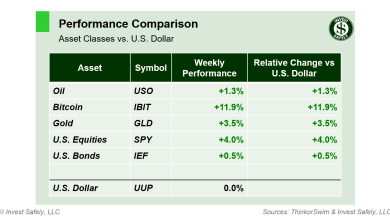

Also benefiting from the risk-on trade was Bitcoin, which led asset class returns for the third week in a row. Oil underperformed.

COMMENTARY

The final Q2 GDP reading showed an increase of 3% quarter / quarter; almost double the first quarter increase of +1.6% q/q, and outpacing the Q2 2023 figure of +2.4%. With Q3 already in the books, any “hard landing” data won’t hit the official measures until sometime in the 4th quarter.

Headline PCE from August showed inflation dropping a bit more than expected, while core was inline (thought slightly higher vs. July).

| PCE (y/y) | Actual | Prior |

Expected |

| Headline | +2.2% | +2.5% | +2.3% |

| Core | +2.7% | +2.6% | +2.7% |

But no one cares about inflation anymore. September labor data is due out this week, which is the new “king” of all things rate cut related, along with the latest ISM survey data for manufacturing and services.

So far, increased geopolitical “activity” in the Middle East hasn’t significantly impacted major markets or economies. Regional conflicts have a way of creating unintended consequences outside the region, and there are several fronts that are currently “hot”.

Closer to home, workers at East and Gulf Coast ports at set to strike on Tuesday, essentially freezing ports from New England all the way to Texas. Negotiations between the International Longshoremen’s Association and the U.S. Maritime Alliance haven’t progressed in months, with neither side meeting in person since the summer. The strike will strand container goods, from produce to electronics, as no one will be loading or unloading the ships. Even a short stoppage could impact corporate earnings in the coming months, not to mention prices paid by consumers.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.