Weekend Stock Market Outlook – August 25 2024

Stock Market Outlook entering the Week of August 25th = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place, with equities looking to close out August at all time highs.

The S&P500 ($SPX) rose 1.4% last week. The index sits ~3% above the 50-day moving average and ~11% above the 200-day moving average.

All three signals show bullish action. Index volume remains below average, which is expected during sessions at the end of August. Traders and their volume should return to their desks after Labor Day.

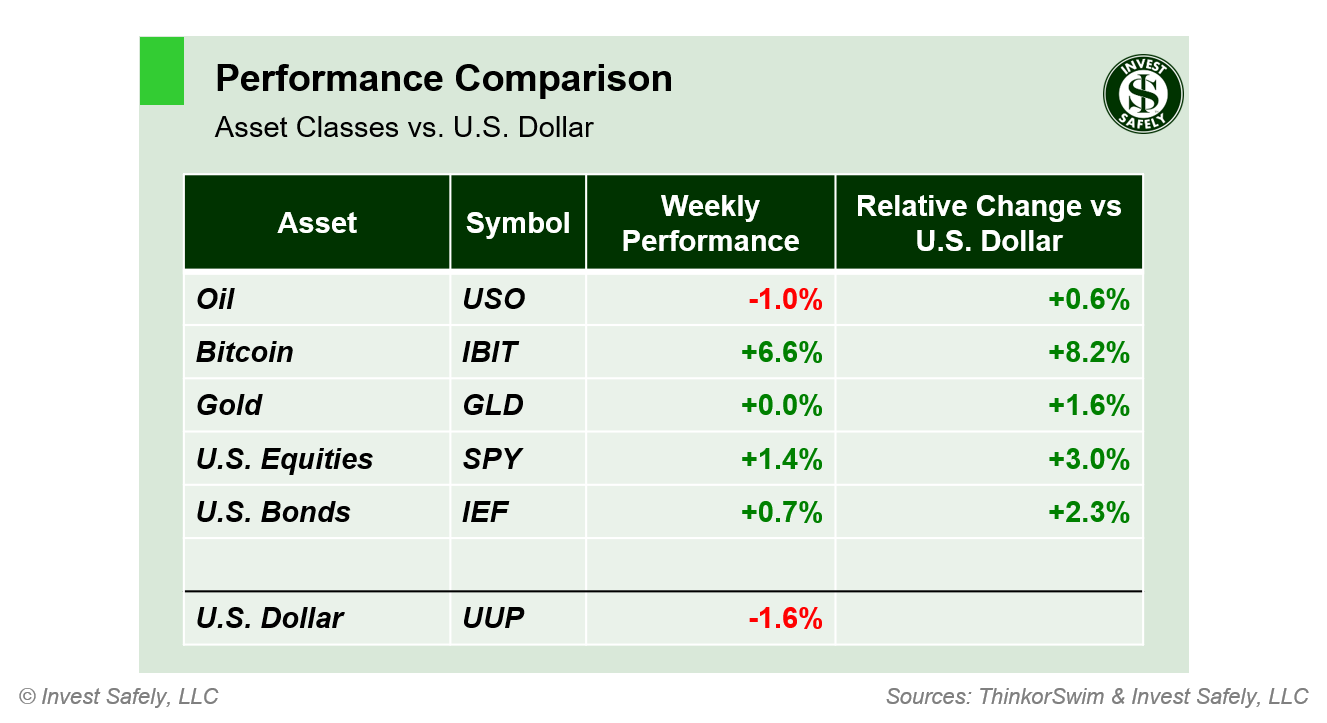

Real Estate ($XLRE) led the way last week, although most sectors advanced for the week. Energy sector ($XLE) was the lone holdout and worst performer, largely due to oil’s underperformance and correlation to the U.S. dollar (more below).

All sector styles had positive returns last week: Small Caps (growth & value) led the way, while large and mega cap growth underperformed the general market.

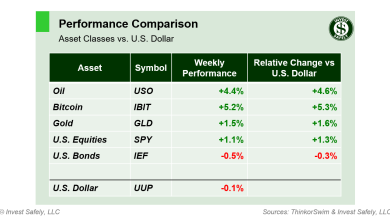

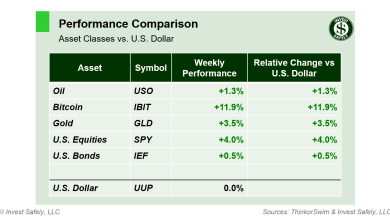

Asset classes benefited from continued weakness in the U.S. dollar. Bitcoin let assets higher, while Oil underperformed. Over the past 3 weeks, moves in oil and the dollar are highly correlated, while dollar correlations with the other assets classes are negative.

COMMENTARY

A rather large, negative revision to non-farm payrolls hit the wires midweek, suggesting the labor market hasn’t been as robust as experts believed. Given employment is now the focus of the FOMC (rather than inflation), it’s no surprise that Federal Reserve Chairman Powell said the time has come to cut interest rates during his Friday speech.

Markets rejoiced. Media outlets were quick to highlight the coming change, saying that inflation is no longer an issue (wrong), and consumers will find relief in the form of lower payments on debt (new mortgages, credit card balances, etc.). Probably a bridge too far, and a dangerous one at that, but you know what they say: “Never let the truth ruin a good story”.

Next week, all eyes are on Nvidia; they release quarterly earnings Wednesday after market close. The data will serve as a catalyst for market moves, given $NVDA’s importance to the artificial intelligence narrative and semi-conductor supply chain, as well as the stocks relative high index weighting. They’ve blown past targets the past few quarters. Lets hope market participants are equally impressed this time around, or it could be a rough start to September.

The market also gets July Durable Goods data on Monday, the 2nd Q2 GDP estimate on Thursday, and July PCE on Friday.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.