Weekend Stock Market Outlook – October 06 2024

Stock Market Outlook entering the Week of October 6th = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook maintains an uptrend, as market participants gear up for the start of earnings season.

The S&P500 ($SPX) rose 0.2% last week. The index sits ~4% above the 50-day moving average and ~10% above the 200-day moving average.

All three indicators ( Average Directional Index, On-Balance Volume, and Institutional Activity ) remained bullish after last week’s action.

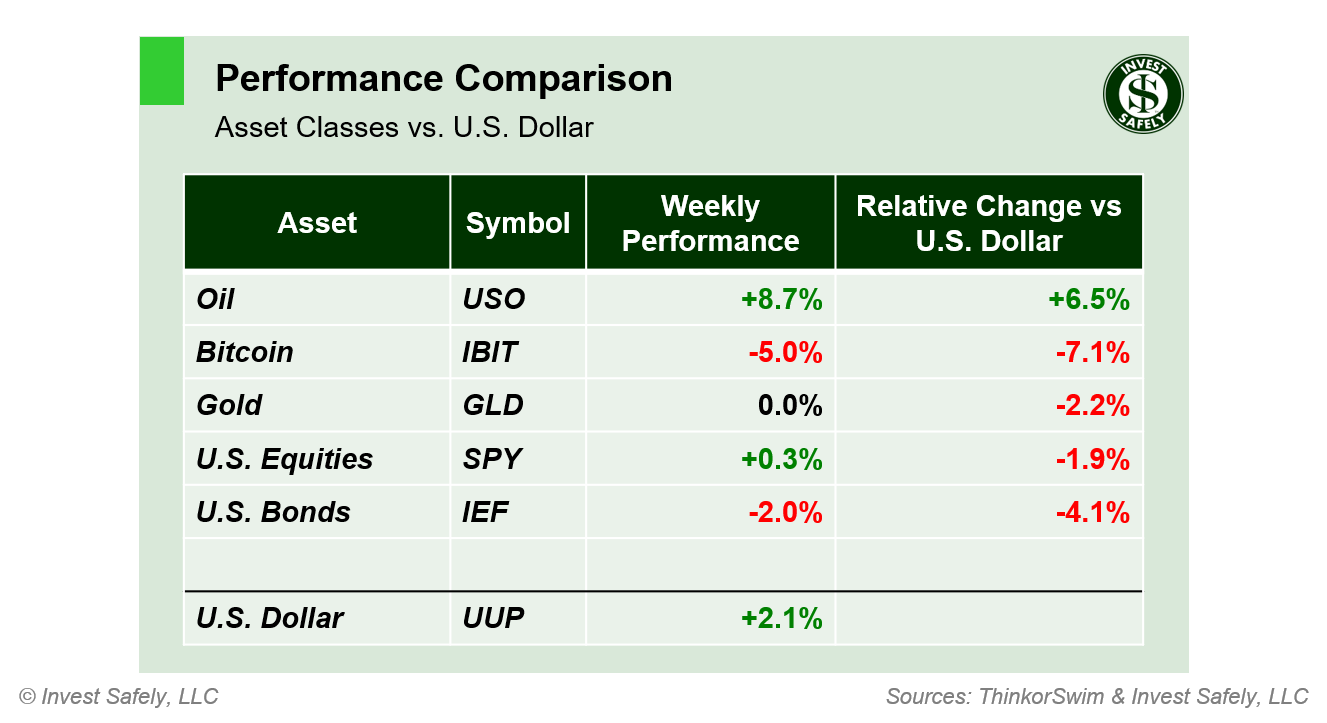

Within the S&P500, the Energy sector ( $XLE ) blew away everything else last week, rallying almost 7%. The volatility in commodity prices has really whipped the sector around lately. Staples ( $XLP ) were the laggard, and have begun to lose key technical levels, along with stocks in healthcare and real estate.

Style-wise, returns were all over the place. Momentum ( $MTUM ) ended up leading to the upside, while Small Cap Value ( $IWN ) led to the downside. Despite the variation, High Beta and Momentum stocks have shown the most technical strength in recent weeks.

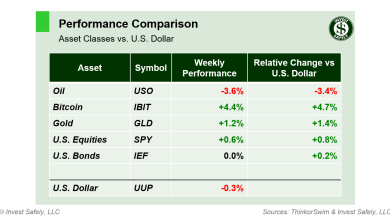

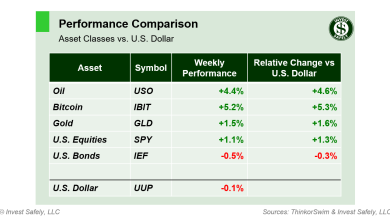

As mentioned above, the volatility in commodity prices has bled through to equities; this week oil ( $USO ) outperformance gave the energy sector a much needed boost. Bitcoin took the week off and underperformed, after leading to the upside for most of September.

COMMENTARY

September labor data came in hot, with JOLTs and NFP beating expectations for the labor market. On the one hand, this is good news for the soft-landing camp, as the Fed raised rates and tamed inflation without disrupting the labor market. One the other hand, talking heads will have a harder time justifying the need for aggressive rate cuts in the near-term.

The ISM survey showed manufacturing remains slightly “contractionary”, albeit unchanged from last month. Services showed a small expansion.

The Longshoremen got back to work after a brief strike, so East Coast ports are operational again and all the people who stocked up on toilet paper can consider donating it to hurricane relief efforts.

We get September CPI and PPI data on Thursday and Friday, respectively. Friday also brings with it the start of earnings season, with big banks reporting quarterly results. All in all, risk-on tickers show the most technical strength ( e.g. within $XLK, $XLC, $SPHB, $MTUM, $IBIT ), while lower volatility and safety trades have weakened ( e.g. $XLP, $XLRE, $SPLV, $SPHD, $IEF ).

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.